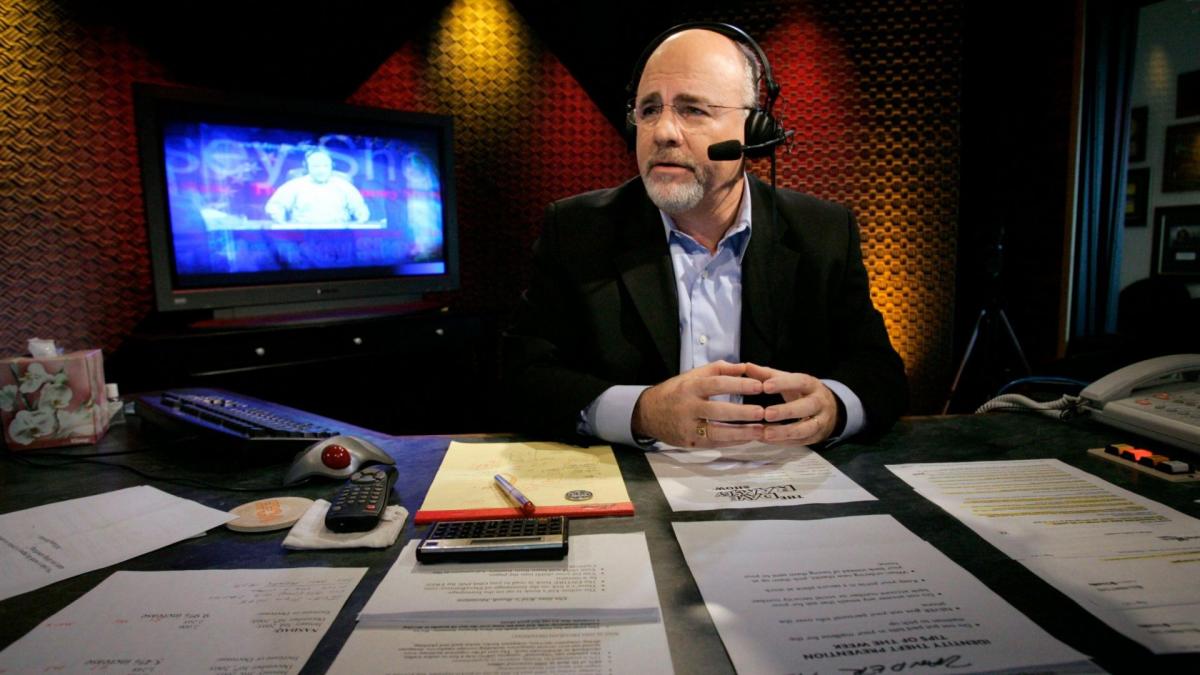

Many people confuse income with wealth, but just because you earn a ton of money doesn’t mean all your money problems go away. Don’t believe it? Personal finance expert Dave Ramsey recently spoke with a California couple living on $300,000 a year who are struggling with debt.

Try This: Clever Ways To Save Money That Actually Work in 2025

Advertisement: High Yield Savings Offers

Find Out: The 5 Car Brands Named the Least Reliable of 2025

This couple — Amber and her husband — are engineers who owe $119,000 in consumer debt: $55,000 in credit cards, $22,000 in student loans, $23,000 in a personal loan and $19,000 in a car loan. They also pay $5,000 monthly on their home — $60,000 a year — which they purchased back in 2021.

So, how did two people earning $300,000 a year go broke, and what can you do to ensure it doesn’t happen to you? Here’s Ramsey’s advice.

The average U.S. consumer owes a little more than $105,000 in debt, according to Experian. But since the real median household income is about $80,000 — per the latest U.S. Census data — this amount of debt might not be too surprising.

For the California couple, though, the problem isn’t their income — it’s their spending.

“You don’t have an income problem. You have a spending problem,” Ramsey told them. “You make $300,000 a year.”

If you want to avoid a similar fate, take a good look at your budget. Whatever your income, you need to learn to be disciplined with your spending to keep out of debt and truly live rich.

Consider This: 9 Downsizing Tips for the Middle Class To Save on Monthly Expenses

According to Amber, they’ve managed to pay off around $50,000 in the past year, but they’re getting impatient and are now considering taking out a home equity loan or second mortgage to pay off their debts.

Ramsey’s advice is to stop acting rich. This means cutting back on unnecessary spending — like excessive dining out or expensive vacations — until the debt is under control.

“Income does not mean wealth,” he said. “Net worth comes from living on less than your income.”

He advised against taking out another loan or consolidating debt. This isn’t truly “paying off” the existing debt. It’s simply moving it.

Ramsey’s advice to the couple, which you can also apply to your own life, was to find a way to live on less and pay more toward your debts.

For Amber and her husband, he suggested living on $200,000 a year and putting $8,000 a month — about $96,000 a year — toward their debts. Doing this would make them debt-free in about 15 months.

The same goes for anyone struggling with debt. One repayment method Ramsey stands by is the debt snowball method. Pay off the smallest debt first, regardless of interest rate, and work your way up until you don’t owe anything.