(Bloomberg) — Stocks drifted near all-time highs ahead of the Federal Reserve decision, with traders split on the size of an interest-rate cut.

Most Read from Bloomberg

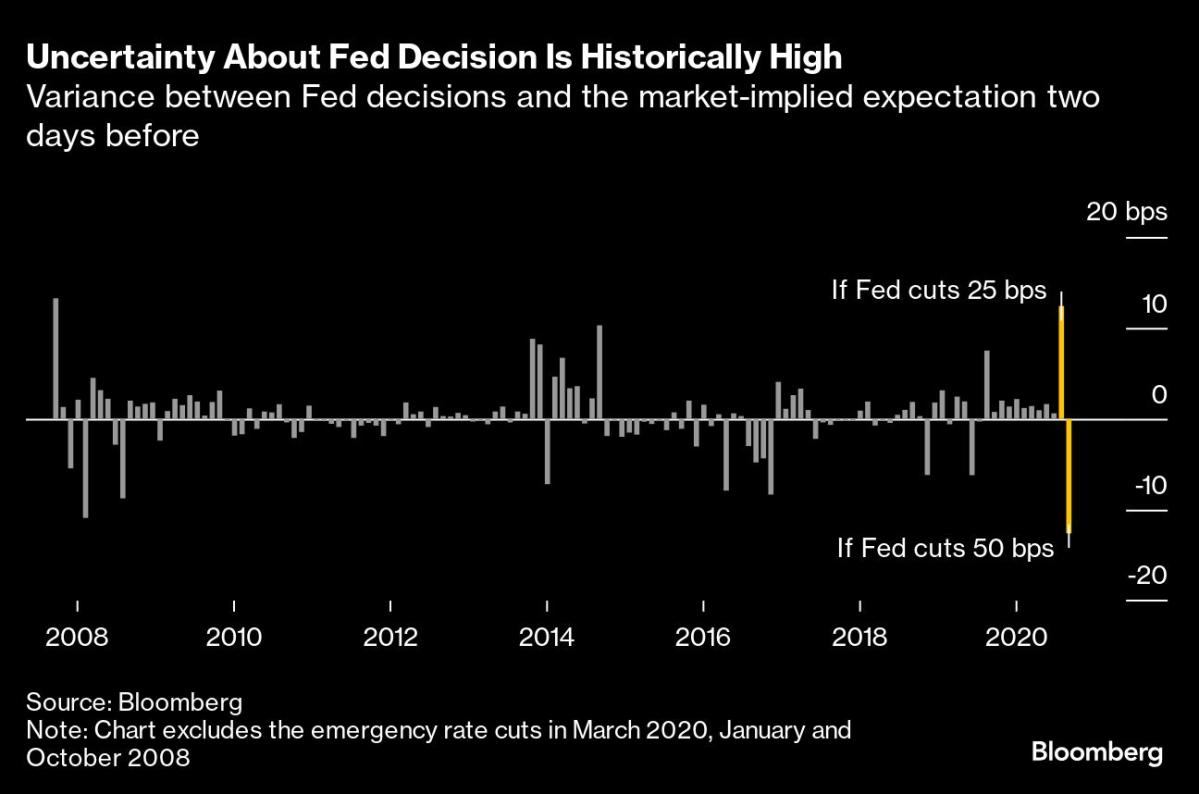

The S&P 500 closed little changed after briefly crossing the threshold of a record amid an increase in US retail sales. Economically sensitive industries once again outperformed tech. Treasury yields edged up, with shorter maturities leading the move. The market-implied odds the Fed announces a 50-basis-point reduction on Wednesday were around 55%.

For several market observers, perhaps the most-important aspect of what happens may be the investor reaction. Could a 25 basis-point reduction leave traders worried the Fed is behind the curve? Could a 50 basis-point move spook markets that the Fed must know the economy is in dire shape? Or will investors be reassured that, whatever the Fed does, Chair Jerome Powell is on top of the situation?

“It’s rare under the Powell Fed for markets to be this ‘up in the air’ on what exactly the Fed will do with just one day to go before the decision,” according to Bespoke Investment Group strategists. “Although maybe the Fed is happy with the market being 100% sure that we’ll at least get a cut.”

A survey conducted by 22V Research showed investors who expect a 25 basis-point reduction are split on whether that cut would deliver a “risk-on” or “risk-off” reaction. Meantime, those betting on 50 basis points think a smaller Fed move would be “risk-off.”

The S&P 500 closed near 5,635. The Nasdaq 100 and Dow Jones Industrial Average were little changed. The Russell 2000 of small firms added 0.7%. Treasury 10-year yields rose two basis points to 3.64%. The dollar gained.

While the market has typically done well on Fed Days when rates have been cut, performance in the week after the first rate cut of a new easing cycle has been pretty weak, according to Bespoke.

The S&P 500 has averaged a drop of 0.56% from the close on the day before the first rate cut through one week later, while eight of 10 sectors have averaged declines as well. Financials and health care have seen the most weakness in the week after the first rate cut, while tech and communication services have bucked the trend and averaged gains.

The Fed will either cut 50 basis points or opt for a 25 basis-point reduction, but signal that they will be more aggressive going forward, according to Matt Maley at Miller Tabak.

Still, he says, that does not guarantee that the stock market and/or bond market will rally in a meaningful way. Maley says the Fed will likely try to convey that a more dovish stance is not seen as something that means they’re suddenly worried about an imminent recession.

“Therefore, given that the stock market is approaching overbought territory, we could still get a ‘sell the news’ reaction to the Fed this week,” he added.

“If the Fed doesn’t initiate its easing cycle with 50 basis points, surely a 25 basis-point move will be enveloped by a dovish tone,” according to Quincy Krosby at LPL Financial. Ryan Detrick at Carson Group said “a larger cut out of the gate makes a lot of sense” given that now the big concern is the potential for a quickly slowing labor market.

Steve Sosnick at Interactive Brokers still believes the Fed should lean to 25 basis points, but notes that years of trading experience have taught him to respect the message of the market.

“And that message has been saying 50,” he said.

Sosnick noted there will likely be widespread disappointment if the Fed opts for 25 basis points. He says equity markets always crave more liquidity, and at the same time, bond markets have all but priced in an aggressive rate cutting path for future meetings. So the smaller cut would bias against both.

Kristina Hooper at Invesco expects the Fed to cut by 25 basis points as a bigger reduction would raise alarm bells about the state of the US economy.

“Recall that the Fed started a brief easing cycle with a 50 basis point cut in March 2020 with the global pandemic upon us; it would be very hard to argue that the situation is so dire now,” she noted.

What Powell says in his press conference about the state of the US economy could help build confidence for those worried about a recession in the near term, Hooper added.

“In addition, it will be valuable to hear Powell’s thoughts on the expected path of rate cuts — in particular, what conditions could trigger a change of course, either a moderation or acceleration in easing,” she noted. “These are just things you can’t glean from the dot plot, so the press conference is ‘must see TV’ in my view.”

Corporate Highlights:

-

Microsoft Corp. raised its quarterly dividend 10% and unveiled a new $60 billion stock-buyback program, matching the size of a repurchase plan three years ago.

-

Intel Corp. made a raft of announcements, spurring optimism that the chipmaker’s turnaround plan is starting to bear fruit.

-

Salesforce Inc. is unveiling a pivot in its artificial intelligence strategy this week at its annual Dreamforce conference, now saying that its AI tools can handle tasks without human supervision and changing the way it charges for software.

-

Newmont Corp., the world’s biggest gold miner, said it’s on track to raise $2 billion — if not more — from selling smaller mines and development projects.

-

JPMorgan Chase & Co. is in discussions with Apple Inc. about taking over a credit card portfolio that rival Goldman Sachs Group Inc. has been trying to ditch.

-

Snap Inc. Chief Executive Officer Evan Spiegel unveiled a new version of the company’s Spectacles smart glasses, revitalizing an effort to build an advanced augmented reality product that may one day replace or rival the smartphone.

-

Ozempic, the blockbuster diabetes shot made by Novo Nordisk A/S, is “very likely” to be one of the next drugs targeted for a price cut in bargaining with the US government’s Medicare program, a company executive said.

Key events this week:

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Eurozone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 was little changed as of 4 p.m. New York time

-

The Nasdaq 100 was little changed

-

The Dow Jones Industrial Average was little changed

-

The MSCI World Index was little changed

-

S&P 500 Equal Weighted Index rose 0.2%

-

Bloomberg Magnificent 7 Total Return Index rose 0.4%

-

The Russell 2000 Index rose 0.7%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.1% to $1.1117

-

The British pound fell 0.4% to $1.3163

-

The Japanese yen fell 1.1% to 142.22 per dollar

Cryptocurrencies

-

Bitcoin rose 4% to $59,953.71

-

Ether rose 3.4% to $2,352.4

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.64%

-

Germany’s 10-year yield advanced two basis points to 2.14%

-

Britain’s 10-year yield advanced one basis point to 3.77%

Commodities

-

West Texas Intermediate crude rose 1.8% to $71.34 a barrel

-

Spot gold fell 0.5% to $2,568.94 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.